St. Joseph Health joins CommonSpirit.org soon! Enjoy a seamless, patient-centered digital experience. Learn more

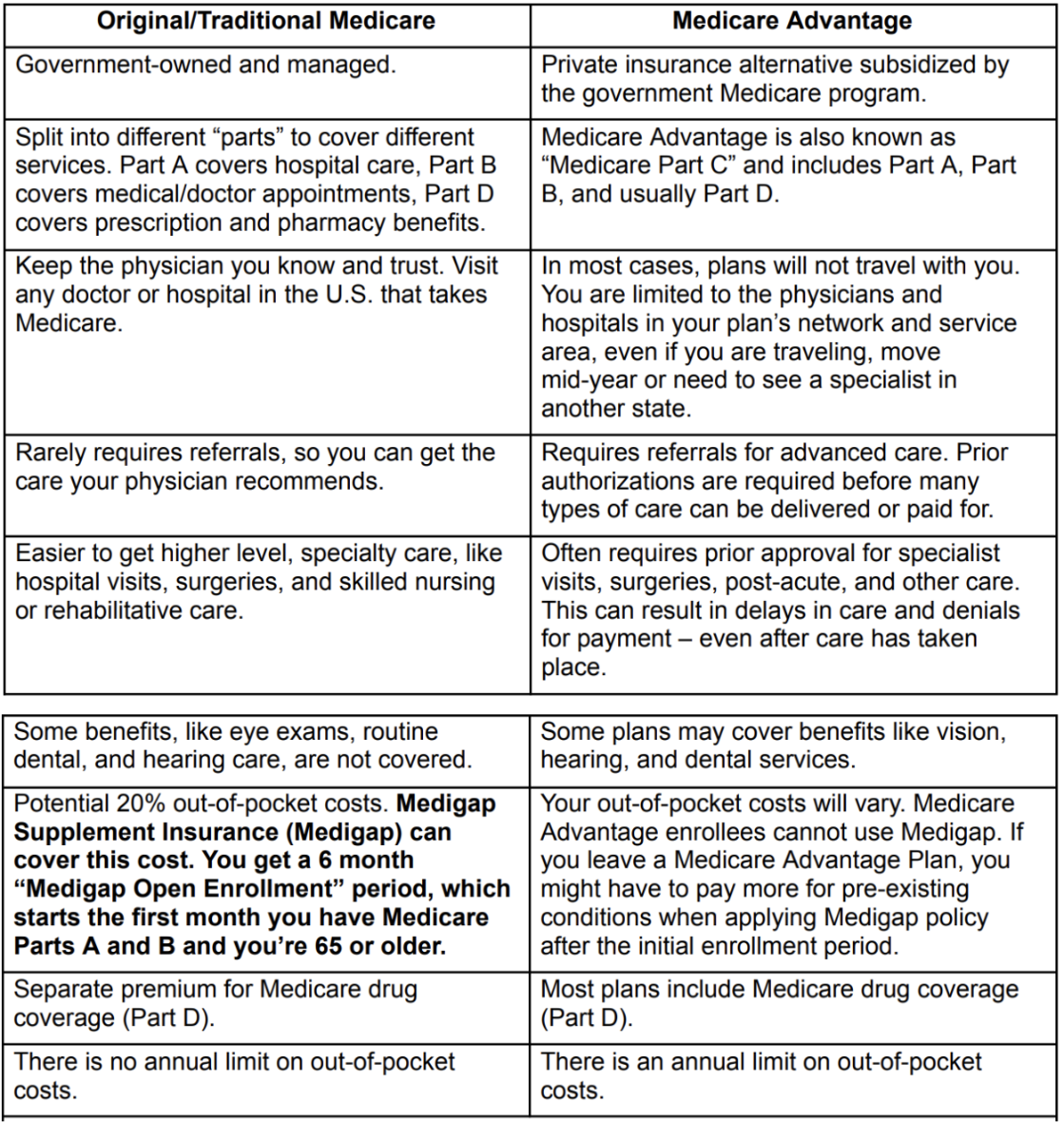

Many seniors can’t afford to be without full health care coverage. It is important to understand how to choose the right Medicare options for your needs. You will read that the services covered by Medicare and Medicare Advantage are the same. But seniors like you are learning that this is often not the case. Many Medicare Advantage plans require you to wait for approval to see if they will pay for the care your physician recommends. Medicare Advantage plans also often delay or deny care that physicians deem necessary, leaving you unable to get the care you need. And if you continue with the care that’s been recommended, Medicare Advantage often refuses to pay for it.

You get what you pay for.

Medicare Advantage plans may promise to cover your monthly expenses or throw in extra services as part of your health care coverage. But many of our patients are finding that those extras come at a cost: not being able to access the care they need or not having it paid for when they need it. And it’s not just here. In 2021, 2 million prior authorization requests were denied for Medicare Advantage patients, further delaying care deemed medically necessary by their provider. While in some cases the monthly cost for Original Medicare is higher, it comes with the peace of mind that you will be able to get the care you need.

Be aware:

Medicare Advantage plans are increasingly removing providers from their networks. This means they are “out of network” with doctors, hospitals, and health systems, and you may need to switch doctors or face higher out-of-pocket costs if you choose Medicare Advantage. You can always receive care at the hospital and from the health care provider of your choice with Original Medicare.

During his hip replacement, James* did not react well to the anesthesia and was admitted for a neurology review. Because of his Medicare Advantage plan, he had to wait at the hospital, unable to walk, while he waited for his insurer to approve his transfer to a rehabilitation center.

*Not patient’s real name

Looking for a doctor? Perform a quick search by name or browse by specialty.